Tax season is underway, and one of the most common questions taxpayers are asking is when their refund will arrive. February 2026 is a key month for refund processing, especially for early filers who submitted their returns soon after the filing season opened. While many refunds move quickly, others may face delays depending on credits claimed, verification checks, and filing method.

IRS February 2026 Filing Season Start

The 2026 tax filing season officially began in late January. From that point, returns started entering the processing system in large batches. The Internal Revenue Service follows a structured workflow, and most electronically filed returns with direct deposit are processed within twenty-one days. Many early filers, especially those with simple returns, often see refunds in as little as seven to fourteen days.

Paper returns still take much longer. Taxpayers who mailed their forms may wait four to eight weeks or more, depending on IRS workload and whether additional review is required.

How February Refund Timing Typically Works

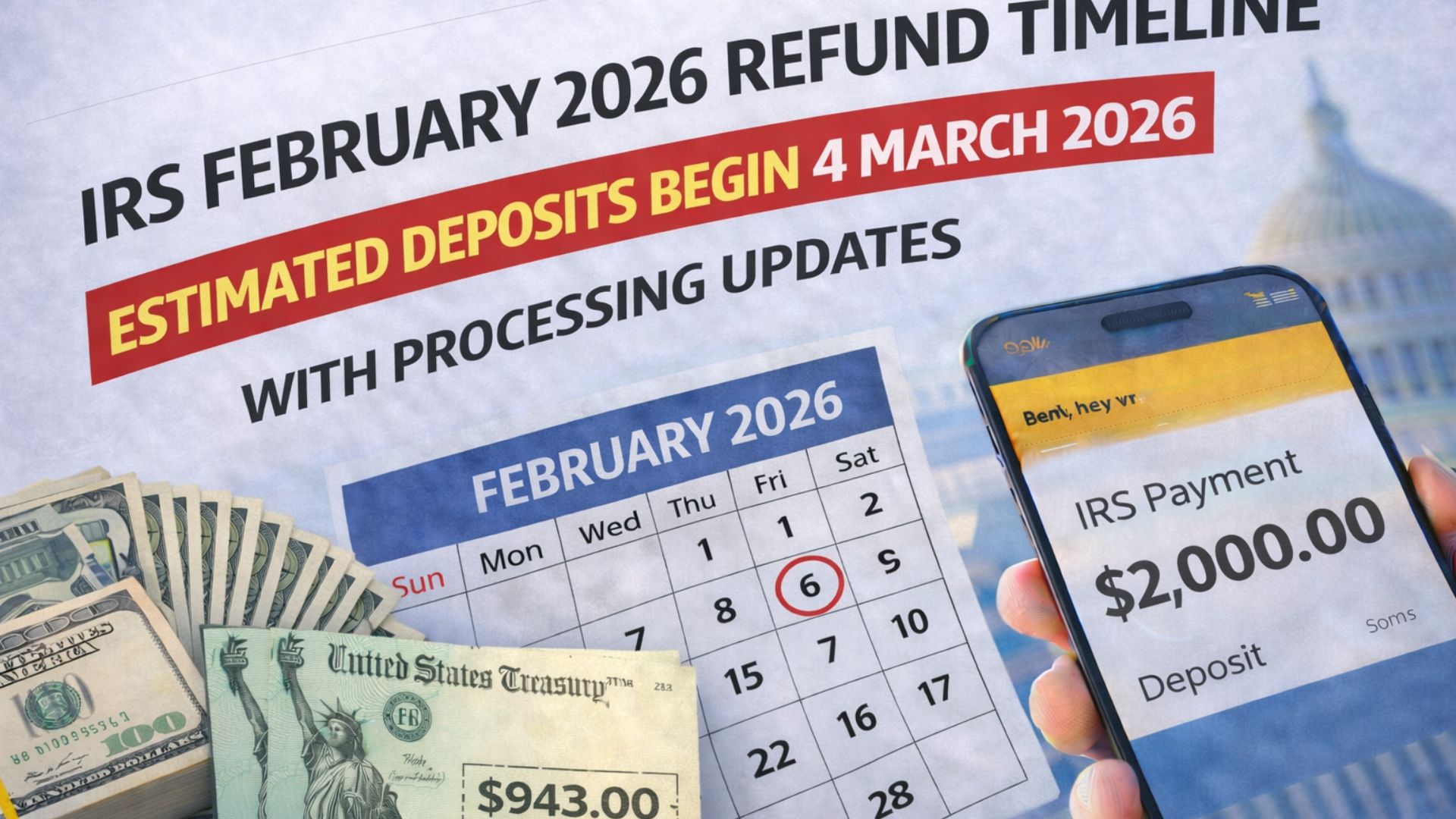

Refunds are not sent out randomly. The IRS processes returns in weekly cycles, and approved refunds are usually released mid-week. If you filed electronically during the first week of the season, your refund may arrive in early to mid-February. Returns filed at the end of January often receive deposits in the second or third week of February. Those who file in early February usually see refunds closer to the end of the month.

These timelines apply mainly to straightforward returns without special credits or review flags.

Reasons Some Refunds Are Delayed

Several factors are slowing refunds for some taxpayers in 2026. Expanded fraud screening means more returns are automatically reviewed, and even small income mismatches can pause processing. Identity verification is also more common, and refunds remain on hold until the taxpayer confirms their information.

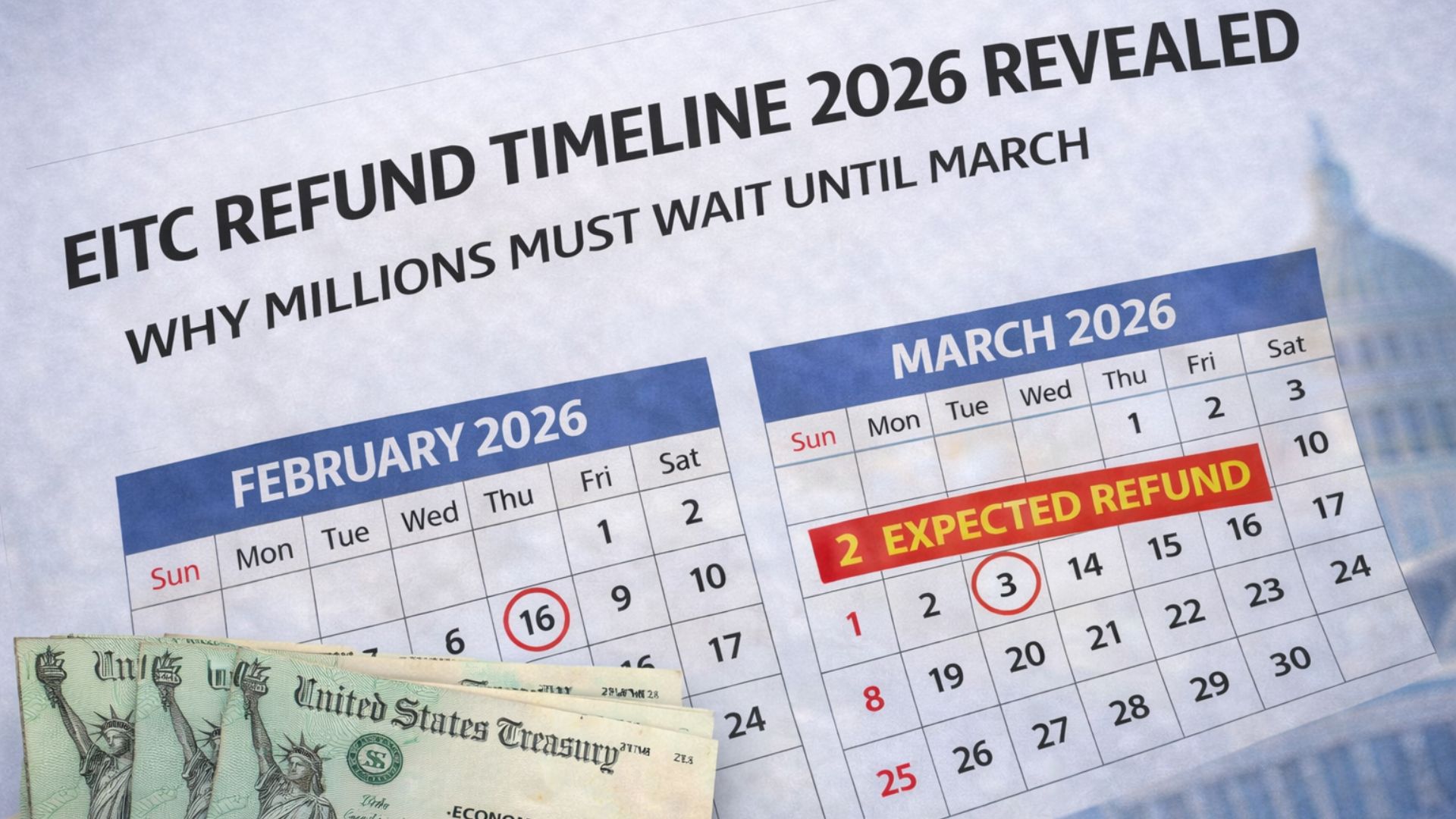

Refundable credits play a major role as well. Returns claiming the Earned Income Tax Credit or Additional Child Tax Credit cannot be released until mid-February due to federal law. Even if approved earlier, the IRS must hold these refunds until the legal release date passes.

Direct Deposit Versus Paper Checks

Direct deposit remains the fastest way to receive a refund. Once approved, funds usually appear in bank accounts within one to three business days. Paper checks take longer because they must be printed and mailed, adding one to two weeks after approval depending on postal delivery speed.

Tracking Your Refund Status

The IRS refund tracking system updates once per day. Refunds move through three stages: received, approved, and sent. If your status does not change for several days, it is usually normal. Delays beyond twenty-one days may indicate a review or request for more information.

Most early electronic filers in February 2026 should receive refunds before the month ends. Accuracy and complete information remain the best ways to avoid delays.

Disclaimer:

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and IRS procedures may change. For official guidance and personal assistance, consult the Internal Revenue Service or a qualified tax professional.