As February 2026 begins, talk of possible $2,000 direct deposits is spreading rapidly across social media and online discussions. Many Americans are struggling with high grocery prices, rent increases, insurance costs, and medical bills. Because of this, any mention of extra federal money creates hope and urgency. However, the reality behind these February deposits is often misunderstood, and it is important to separate facts from assumptions.

Why February Often Brings Large Deposits

February is one of the busiest months for federal payments. It sits at a point where tax refunds and monthly federal benefits often arrive close together. When multiple deposits hit a bank account within a short time, the total amount can look like a single large payment, even though it is not.

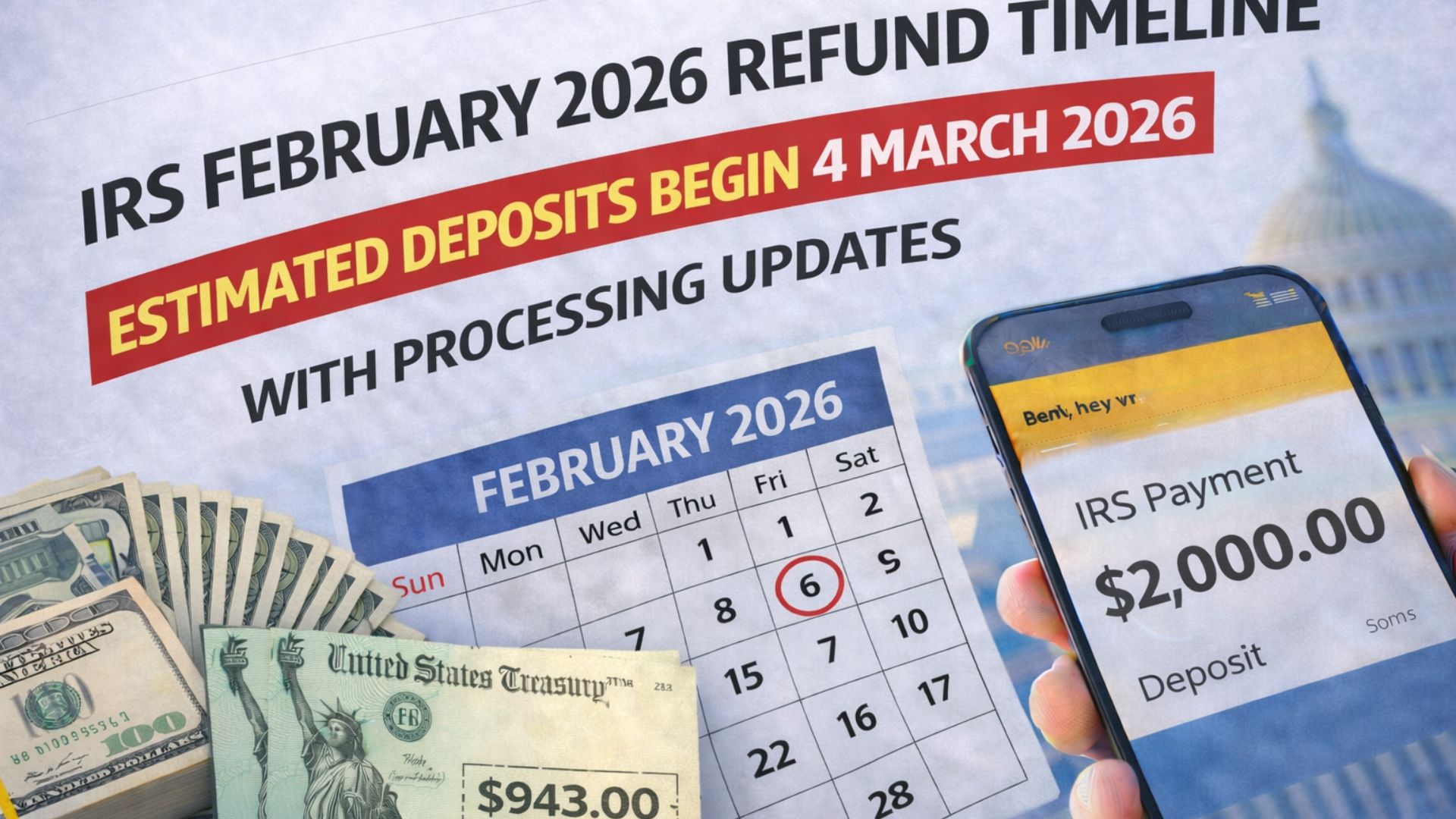

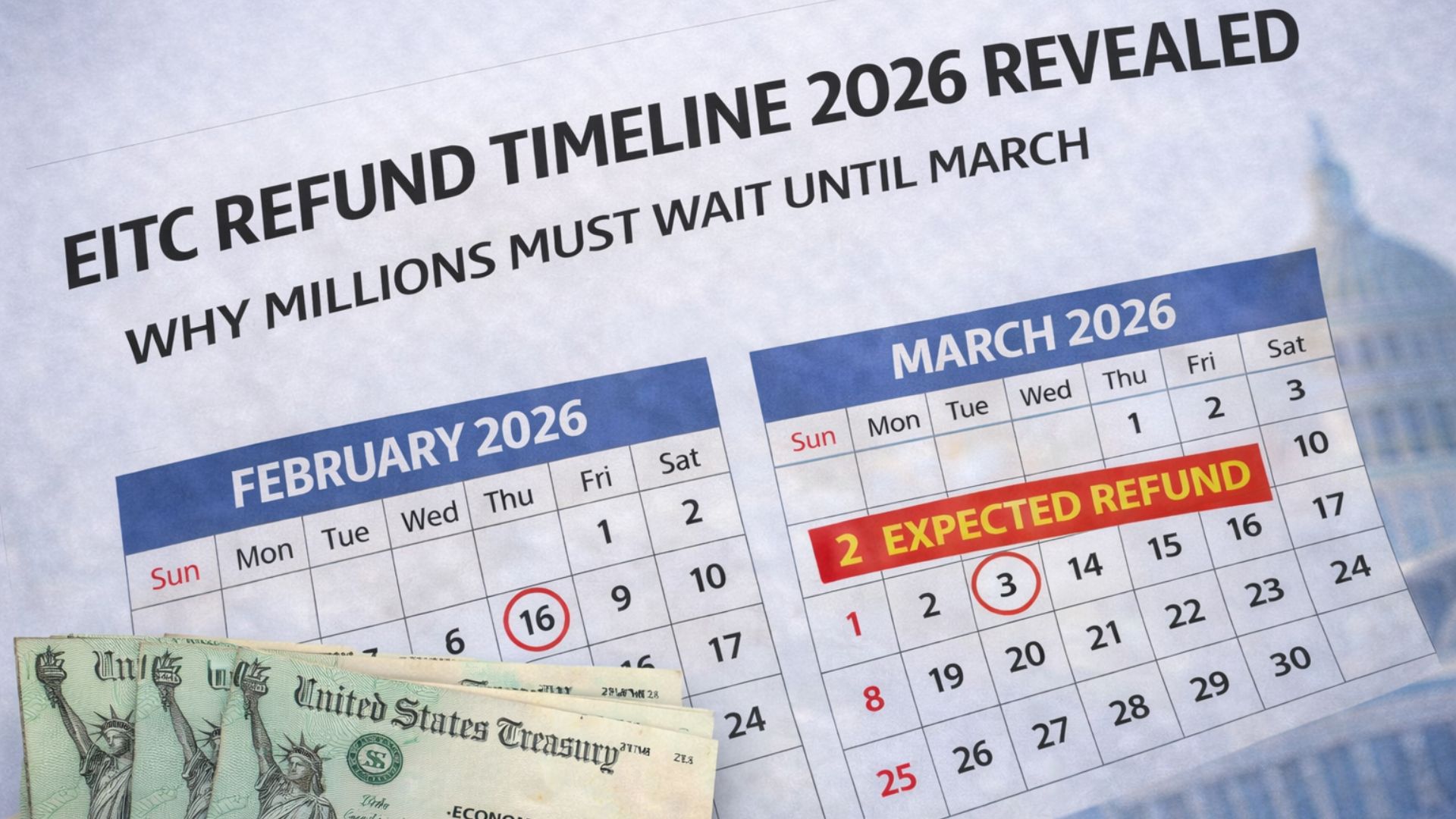

The Role of Tax Refunds in February 2026

Many taxpayers who file early and choose direct deposit receive refunds in February. Refund amounts vary widely depending on income, tax withholding, and family size. Refundable tax credits can significantly increase these amounts. Credits related to work income and dependent children often push refunds higher, sometimes close to or above $2,000. These refunds are issued through the Internal Revenue Service and follow standard processing timelines.

Federal Benefits Add to the Total

In addition to tax refunds, federal benefit payments continue on their regular schedules. Social Security retirement benefits, SSI, SSDI, and Veterans Affairs benefits are paid monthly. Many recipients receive benefits exceeding $1,000. When these payments arrive around the same time as a tax refund, the combined total can easily approach $2,000 or more. These benefits are managed by agencies such as the Social Security Administration and the Department of Veterans Affairs.

Why Not Everyone Will See $2,000

Not every household will receive a deposit near $2,000. Refunds and benefits are calculated using strict formulas based on income, work history, and eligibility. Some payments may also be reduced due to offsets for past-due taxes, child support, or other federal debts. These adjustments can lower the final amount received.

Understanding Social Media Confusion

The number $2,000 has strong emotional impact because of past stimulus payments. When people share screenshots of deposits online, the context is often missing. What looks like a new federal payment is usually a combination of routine refunds and benefits rather than a newly approved program.

Staying Safe From Scams

Whenever payment rumors circulate, scams increase. Government agencies do not ask for personal or banking information through texts, calls, or emails. Official updates only come through verified government websites and notices.

What February 2026 Really Represents

February 2026 does not signal a new stimulus payment. It reflects the normal operation of tax refunds and federal benefits. Some households will see deposits near $2,000, but these amounts are based on existing rules and timing, not surprise federal relief.

Disclaimer

This article is for informational purposes only and does not provide financial, legal, or tax advice. Federal payment amounts, eligibility rules, and timelines depend on official laws and agency regulations and may vary by individual situation. Readers should consult the Internal Revenue Service, Social Security Administration, Department of Veterans Affairs, or other official government sources for accurate and up-to-date information.