Millions of low- and moderate-income workers who rely on the Earned Income Tax Credit will face a built-in refund delay during the 2026 tax filing season. This delay can be frustrating, especially for families who depend on their refunds to cover rent, utilities, or other essential expenses. However, the delay is not caused by filing mistakes or slow processing. It is required by federal law and applies to everyone who claims certain refundable credits.

Why EITC Refunds Are Delayed in 2026

The delay is the result of the Protecting Americans from Tax Hikes Act of 2015, commonly known as the PATH Act. This law requires the Internal Revenue Service to hold refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit until mid-February. The rule applies even if a taxpayer files early, uses direct deposit, and submits a completely accurate return.

Purpose of the PATH Act Delay

The main goal of the PATH Act is fraud prevention. Refundable credits are a common target for identity theft and false claims. The waiting period gives the IRS time to verify income, confirm eligibility, and match information with employer and government records. Although this extra review slows down refunds, it has significantly reduced fraudulent payments since the law was introduced.

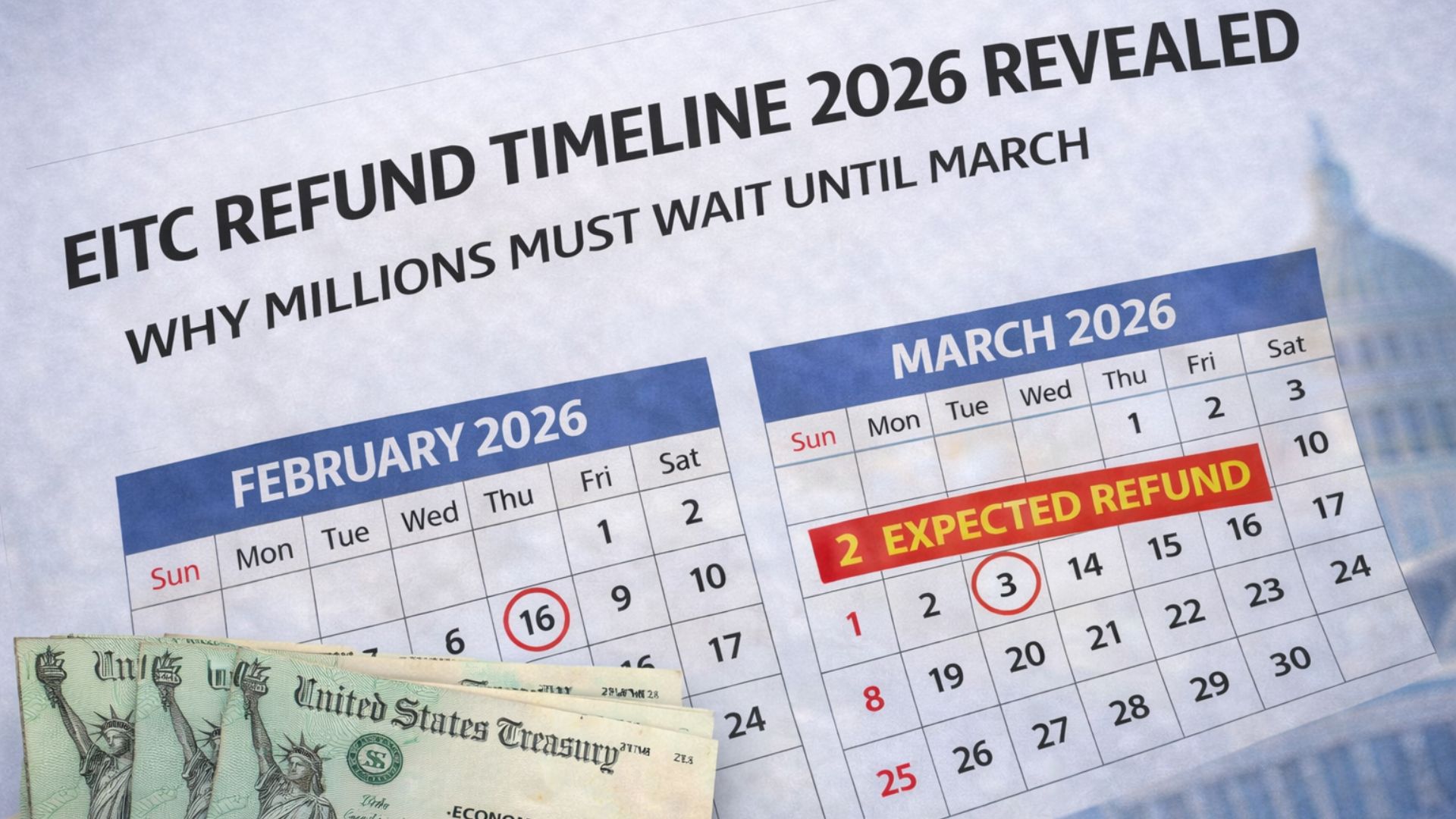

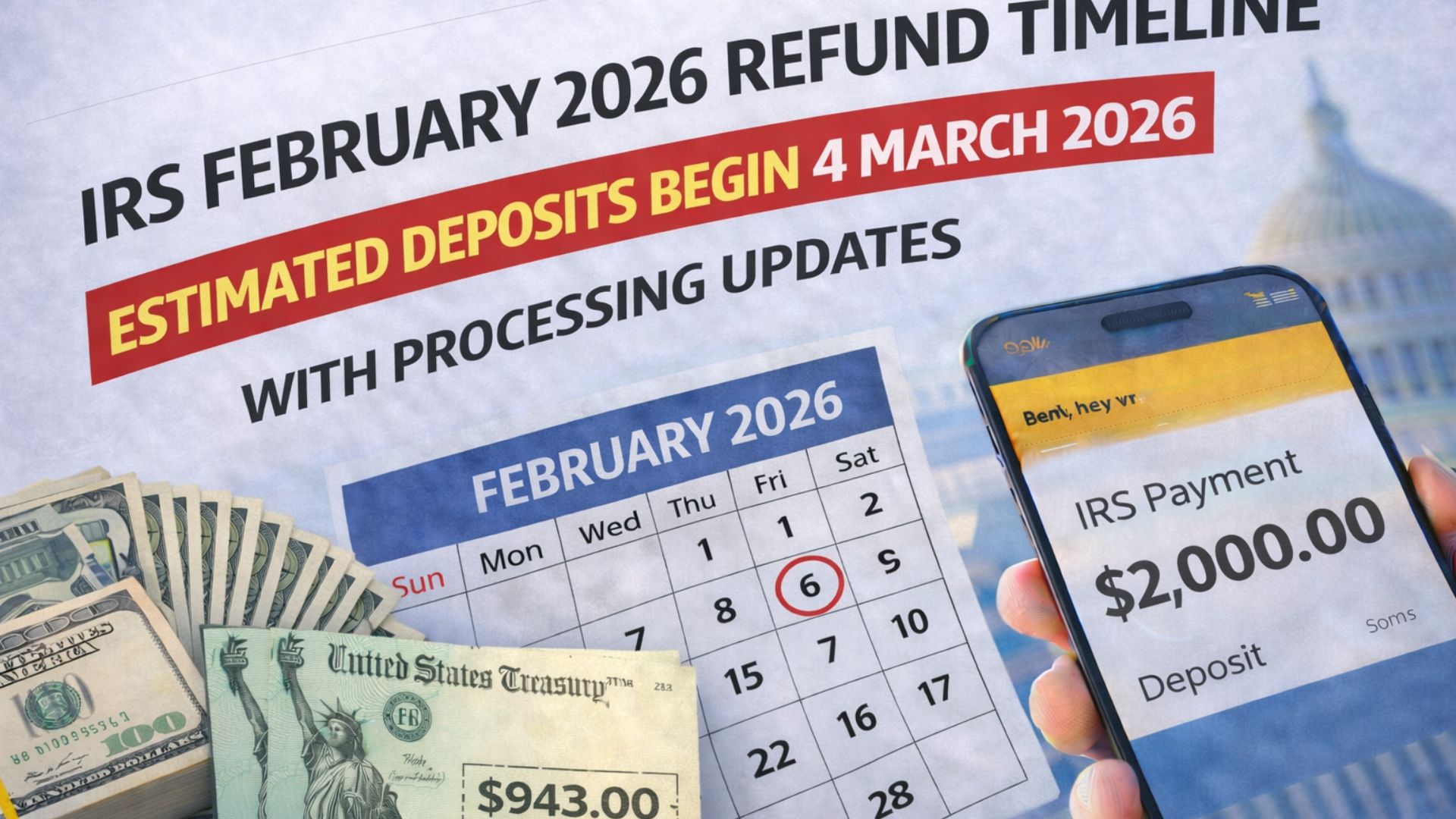

2026 Tax Season Timeline for EITC Filers

The 2026 tax season opened on January 26, and taxpayers have until April 15 to file their 2025 returns. Many taxpayers who do not claim EITC receive refunds within about 21 days if they file electronically with direct deposit. EITC filers follow a different timeline. Even if a return is accepted in late January, the IRS cannot release the refund before mid-February. In most cases, deposits begin arriving in late February and continue into early March.

Why the Entire Refund Is Held

When EITC or ACTC is claimed, the law requires the IRS to hold the entire refund amount. This includes money from tax withholdings or other credits. The refund is released only after all required checks are completed, which is why EITC filers often wait longer than others.

How to Track Your Refund

The most reliable way to monitor refund progress is the IRS “Where’s My Refund” tool or the IRS2Go mobile app. These tools update daily and usually begin showing specific deposit dates by late February. If there is no update by mid-March, the IRS may need additional information.

Preparing for the Wait

Filing electronically, choosing direct deposit, and double-checking all information can help avoid extra delays. While the wait can be stressful, the EITC remains one of the strongest programs supporting working families, and the safeguards help ensure payments go to those who truly qualify.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. Tax laws, refund timelines, and IRS procedures may change. Individual circumstances vary. Readers should consult official IRS resources or a qualified tax professional for guidance specific to their situation.