In recent weeks, talk of a possible $2,000 federal deposit in February 2026 has spread quickly across news headlines and social media. With prices still high for rent, groceries, healthcare, and utilities, many Americans are hoping for extra financial help. Retirees, low-income workers, and families on fixed incomes are especially interested. Despite the growing attention, it is important to understand what is confirmed and what is still only speculation.

Current Status of the $2,000 Federal Deposit

As of early February 2026, no $2,000 federal payment has been officially approved. There is no signed law, executive order, or confirmed announcement from Congress or federal agencies. The payment being discussed remains a proposal and part of ongoing policy conversations. Claims that the deposit is guaranteed or already scheduled are not accurate at this time.

What Type of Payment Is Being Discussed

The $2,000 amount is described as a possible one-time relief payment. It is not part of monthly Social Security benefits, Supplemental Security Income, or any permanent federal program. The idea is similar to earlier emergency-style payments used during periods of economic stress. Supporters believe a single payment could help people manage urgent expenses, while critics point out that no funding or final approval exists yet.

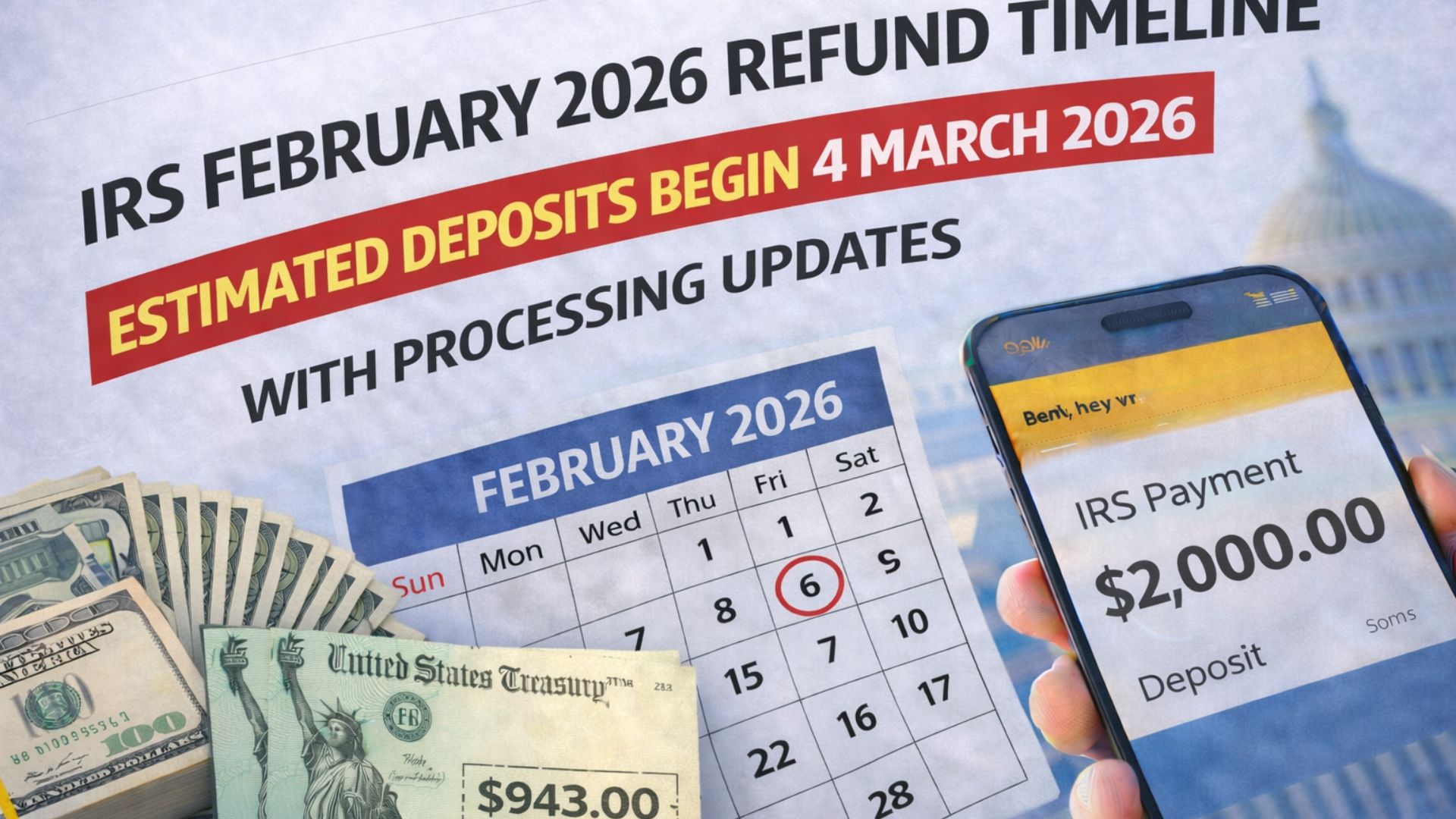

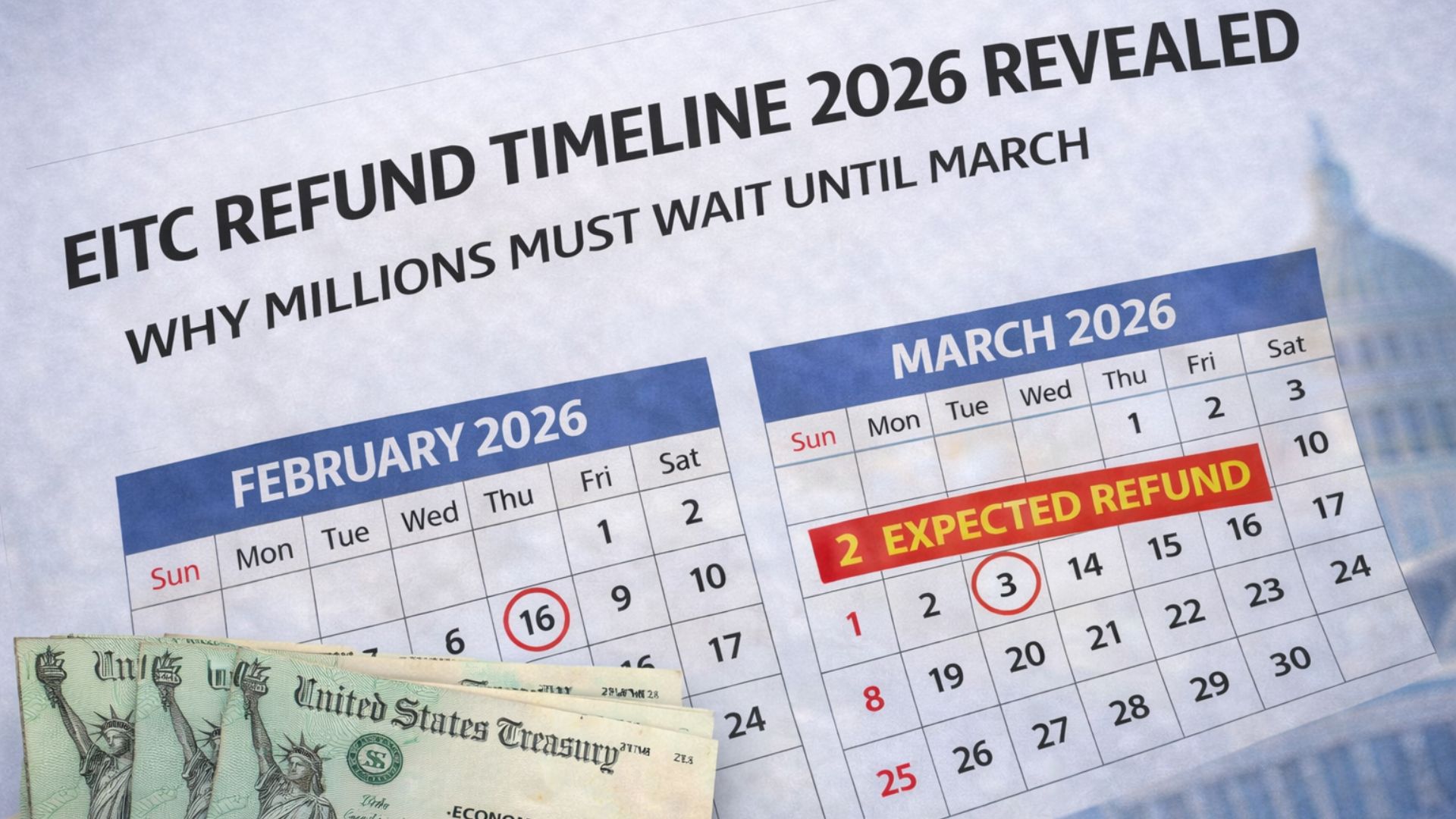

Why February 2026 Is Mentioned

February is often mentioned because it is a busy period for federal payments. Many Americans receive tax refunds, updated benefit payments, and cost-of-living adjustments early in the year. When multiple deposits arrive close together, it can create confusion and fuel rumors. However, without congressional approval, February 2026 should be seen only as a possible timeframe, not a confirmed payment date.

Possible Eligibility Scenarios

Although no official rules exist, discussions often refer to past relief models. If approved, eligibility would likely depend on income limits and tax filing status. People receiving benefits through the Social Security Administration or filing taxes with the Internal Revenue Service could be evaluated using existing records. Legal residency and a valid Social Security number would almost certainly be required.

How Payments Would Likely Be Sent

If authorized, most payments would probably be issued automatically. Direct deposit would be the fastest option for those with bank details on file. Others could receive paper checks or prepaid debit cards. Payments would likely be released in phases rather than all at once.

Staying Prepared and Avoiding Misinformation

Even though the payment is unconfirmed, keeping tax records, bank details, and addresses updated is helpful. It is equally important to avoid scams. Government agencies do not ask for personal information through unsolicited messages or charge fees to release payments.

As of now, the $2,000 federal deposit remains a proposal, not a promise. Relying only on verified information is the safest approach.

Disclaimer: This article is for general informational purposes only. The $2,000 federal payment discussed has not been officially approved. Eligibility rules, payment methods, and timelines may change if legislation is passed. Always confirm updates through official government sources before making financial decisions.