The 2026 IRS tax refund schedule is already a major topic for millions of Americans preparing to file their 2025 tax returns. With household budgets still tight, refund timing matters just as much as the amount. While the overall filing calendar looks familiar, understanding how refunds actually move through the system can help taxpayers avoid confusion and delays.

When the 2026 Tax Filing Season Begins

The Internal Revenue Service is expected to begin accepting 2025 tax returns in the last week of January 2026. Filing a return before the IRS officially opens does not speed up processing. Returns only enter the system once IRS processing systems are live. The standard tax filing deadline remains April 15, 2026, and taxpayers can request an extension if they need additional time to file.

How Refund Timing Really Works

There is no fixed refund date for taxpayers. Refund timing depends on how the return is filed, how accurate it is, and whether additional review is required. Electronic filing combined with direct deposit remains the fastest method. In many cases, refunds are issued within 21 days of acceptance. Paper returns usually take much longer, sometimes several weeks or more.

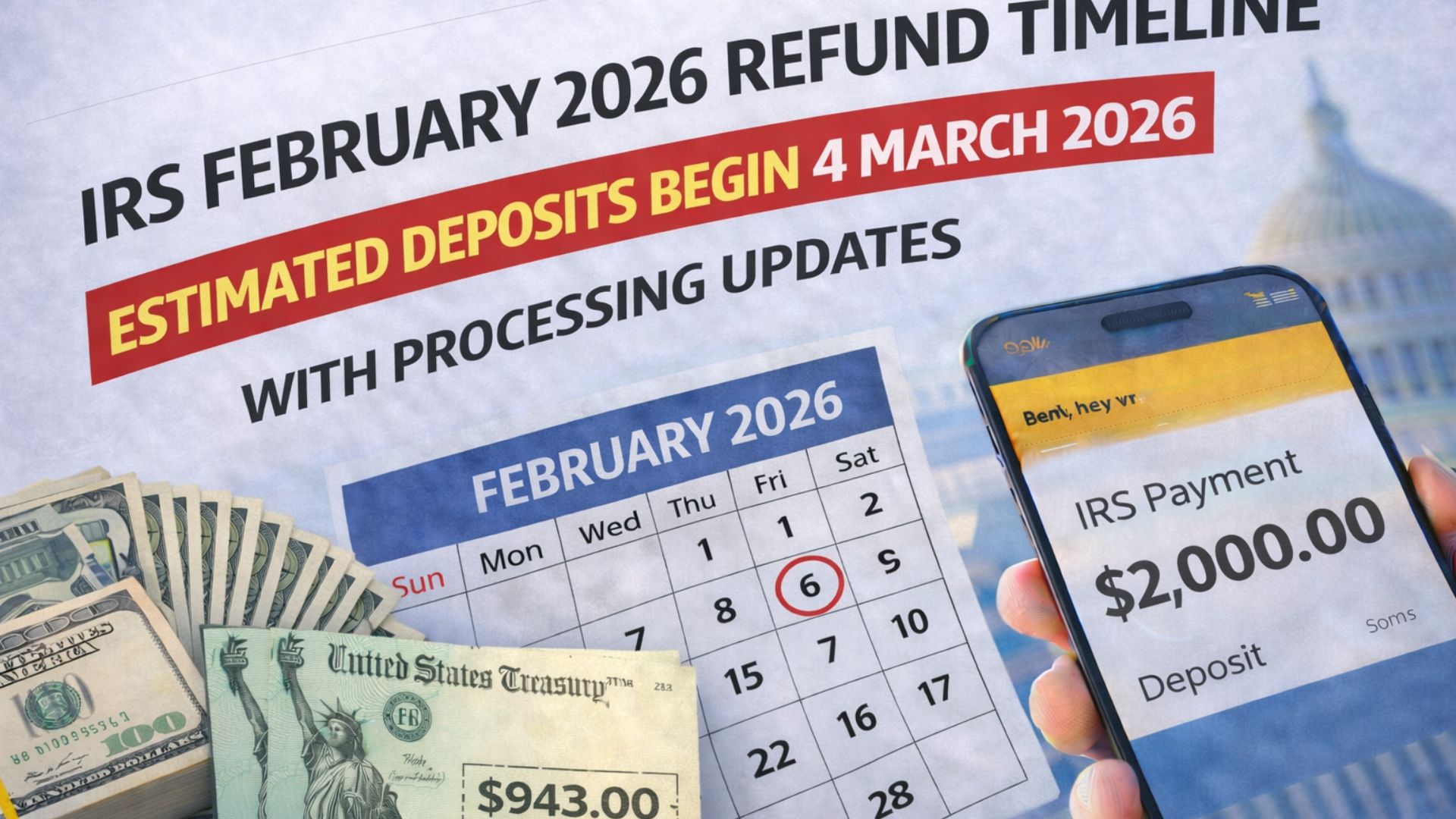

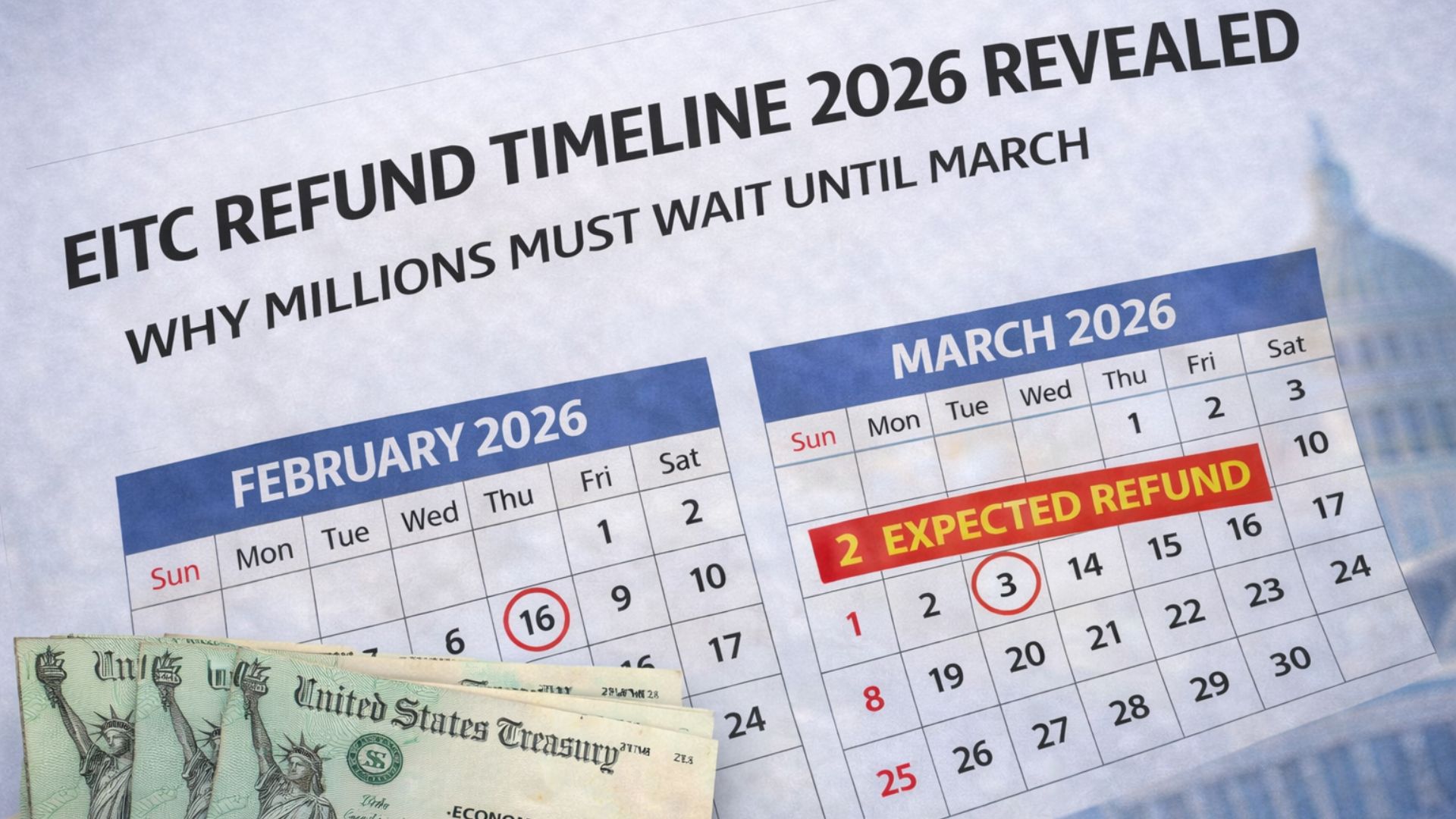

Credits That Can Delay Refunds

Refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit are legally held until at least mid-February. This delay is part of federal fraud prevention rules and applies every year. Even if the return is correct, the IRS cannot release these refunds earlier. Once released, they are typically sent quickly through direct deposit.

Common Reasons Refunds Are Delayed

Mistakes such as incorrect bank details, missing forms, or mismatched employer income data can slow processing. Returns involving self-employment income or multiple income sources may also take longer. Filing early can reduce identity theft risks, but accuracy matters more than speed. A carefully reviewed return is less likely to be flagged for additional checks.

Tracking Refund Status Online

The IRS provides the “Where’s My Refund?” tool to help taxpayers track their refund status. Updates are made once per day and show when a return is received, approved, and sent. Even after a refund is marked as sent, it may take one or two business days to appear in a bank account.

What to Expect From the 2026 Season

The IRS expects gradual improvements in processing speed, but delays are still possible due to fraud checks and staffing limits. Refund timelines should be treated as estimates rather than guarantees. Using electronic filing, choosing direct deposit, and reviewing personal information carefully remain the best ways to avoid problems.

Final Thoughts on the 2026 Refund Schedule

The 2026 IRS refund schedule follows familiar patterns. Most electronic filers who choose direct deposit can expect refunds within 21 days, assuming there are no issues. Staying informed through official IRS tools helps manage expectations and avoid misinformation.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund timelines are estimates and may vary based on individual circumstances. Readers should consult the Internal Revenue Service or a qualified tax professional for the most accurate and up-to-date guidance.